Finances and accountability

The foundation of our aid is our donors. We are committed to handling the donations they entrust to us with the utmost care. Your donation goes where it is needed - to the cleft children.

Sources and use of funding

As per our statutes, we use our donation income to fund treatments for patients with cleft lip and palate in developing countries, and maintain the aid infrastructures necessary to provide these treatments. Each of our projects is led by a surgeon. Every treatment is documented by the doctors on site in our patient database.

Every month, we check the documentation. For each properly documented surgery, we pay out a fixed case fee to the projects. The amount varies from country to country depending on the costs of providing a surgery in the country in question. On average, the fee currently amounts to some 300 euros per operation performed.

This fee is used to pay all costs of the surgery: the hospital stay, anaesthetics and medication, and the wages for the team: doctors, nurses and project coordinators.

Donation income and expenditure in 2024

In 2024, we recorded donation income of €3,314,047, including €247,000 from bequests. Total expenditures amounted to €3,300,664. The breakdown by cost category is shown in the chart below.

Thanks to investment income of €122,000 in 2024—significantly above the previous year’s €73,000—we were able to allocate €136,000 to restricted reserves from unspent donations.

How your donation makes an impact

81% – Expenditures for program services (our statutory purposes)

19% – Expenditures for administration, fundraising & public relations

All expenses for the development and implementation of our aid projects are included under “expenditures for program services.” In 2024, €2,658,795 flowed into project work—€271,560 more than in the previous year.

The increase is primarily due to the expansion of activities in our focus countries Bangladesh and Pakistan, the positive development of the still-young project in Ethiopia/Somalia, and the launch of a pilot project in Angola.

Thus, in 2024, expenditures for program services accounted for 81% of total expenditures.

And the rest? The remaining 19% covers fundraising and public relations as well as administration—measures that raise awareness of our work, generate donations, and ensure the targeted use of funds.

Your donation makes a difference—not only in numbers. It changes children’s lives, for good.

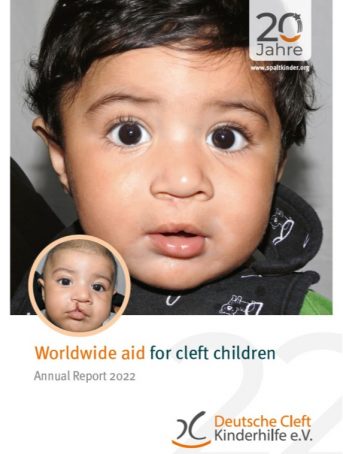

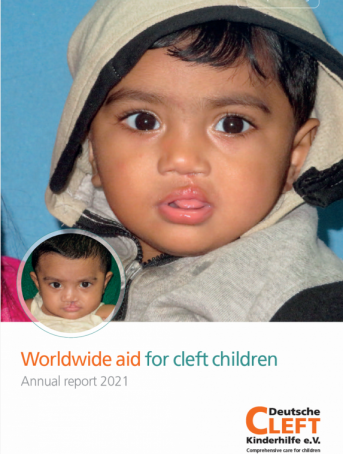

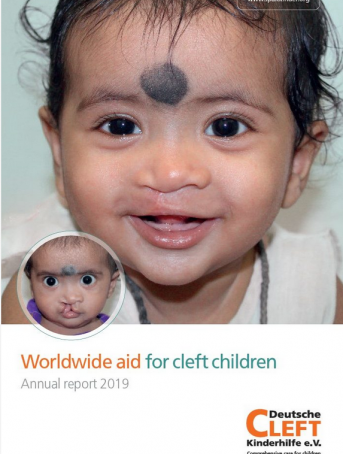

Annual reports

Our annual financial statements are audited by an external company in accordance with the exacting DZI guidelines. This detailed financial report is published on October 1 of the following year in our online annual report, which you can also download as a PDF below. In the preliminary version, the focus is on a comprehensive review of the year with impressions from our project countries. You can also order this preliminary report from us in printed form. Simply use our contact form.

Please note that only the annual reports since 2019 are available in English. You can download older reports in German from the German version of our site. Likewise, the expanded annual report with the full financial statement also is available only in German and can be downloaded on the German version of this page, here.

DZI Seal of approval

A token of dependability: Since 2012, we have been proud bearers of the DZI seal of approval for our responsible use of our donors’ funds. The first award was based on an audit of our 2010 finances, and the certification process is repeated annually. The seal is awarded by the German Central Institute for Social Issues (DZI), based in Berlin. The DZI seal of approval certifies that the organization bearing it is responsible and careful in the use of the donations entrusted to them.

For more information for donors read our article.

Nonprofit status

As a promotor of charitable purposes and public health, Deutsche Cleft Kinderhilfe e.V. is exempt from corporation tax in accordance with Section 5 (1) No. 9 of the Corporation Tax Act and exempt from trade tax in accordance with Section 3 No. 6 of the Trade Tax Act (exemption notice from the Freiburg-Stadt Tax Office, tax number 06469/47127, January 13, 2023 for the last assessment period 2019 to 2021).

Due to our nonprofit status, we can issue donation receipts for donations received. In order to minimize the administrative load, a collective receipt for all donations made by a donor in the previous year is sent out at the beginning of the following year. Should you require your receipt at an earlier time, please contact us.